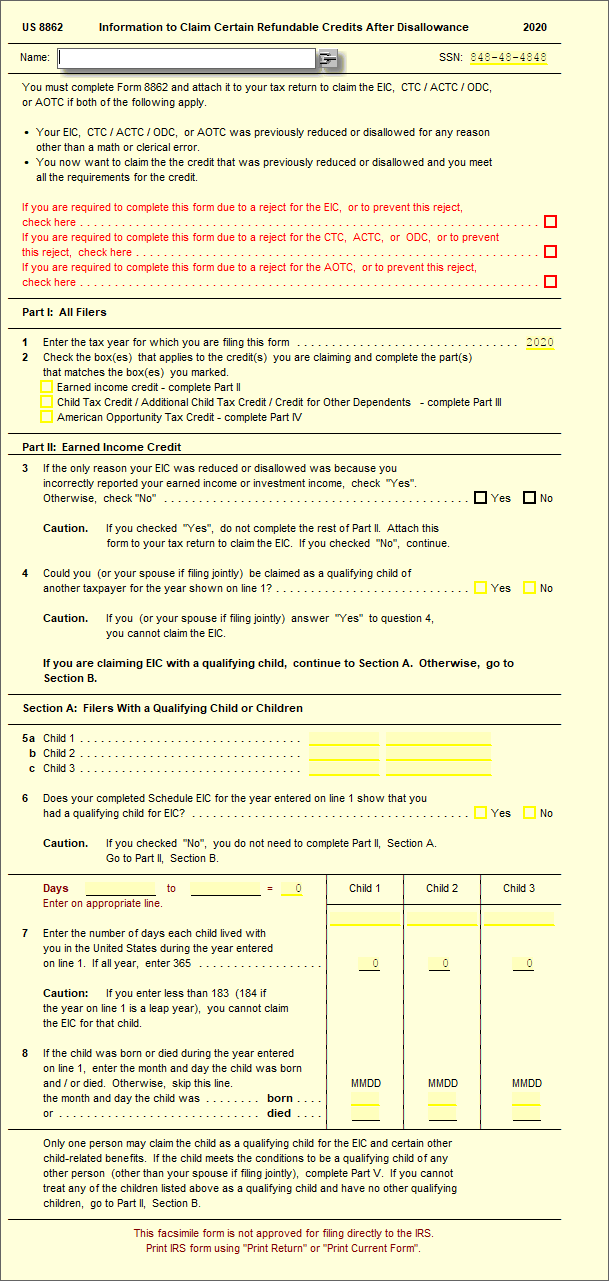

What is the form used for? :

- Taxpayers complete Form 8862 and attach it to their tax return if their earned income credit (EIC), child tax credit (CTC)/additional child tax credit (ACTC), credit for other dependents (ODC), or American opportunity credit (AOTC) was reduced or disallowed for any reason other than a math or clerical error.

Is the form Supported in our program? Yes

How to access the form: To access the form, you will need to open a 1040 return on the online/desktop and then go to Add Form/Display and type 3800.

Limits to the form: This form cannot be copied.

IRS Publication: https://www.irs.gov/forms-pubs/about-form-8862

Solution Articles: