What is the form used for? :

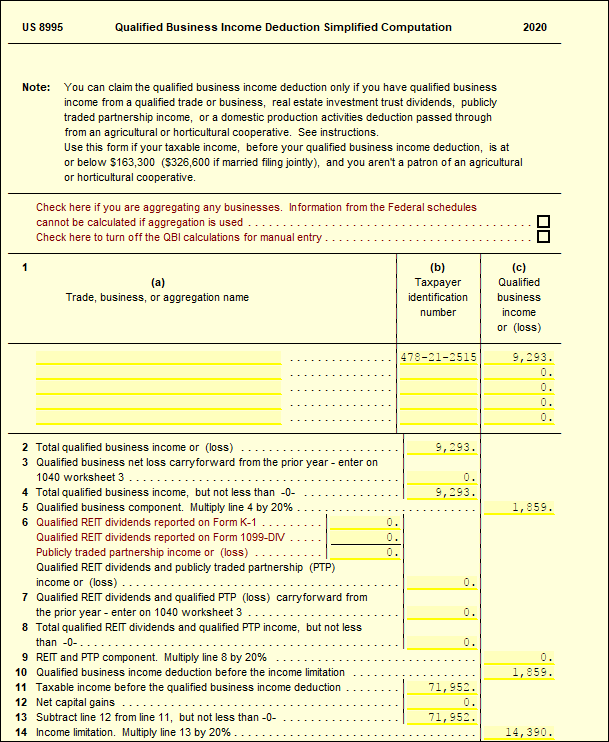

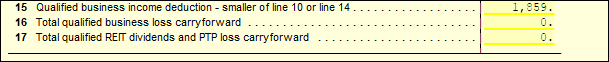

Use Form 8995 to calculate your qualified business income (QBI) deduction. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of their net QBI from a trade or business, including income from a pass-through entity but not from a C corporation, plus 20% of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. However, your total QBI deduction is limited to 20% of your taxable income, calculated before the QBI deduction, minus net capital gain.

Is the form Supported in our program? The 8995/8995A are supported by the 1040 and 1041 packages, available in both Desktop and Online versions of UltimateTax.

How to access the form: In a 1040 or 1041 return, use the Add Form function to add form 8995 or 8995A.

Limits to the form: This form is only available to the 1040 and 1041 packages. There is a limit of one form per return.

IRS Link: https://www.irs.gov/instructions/i8995