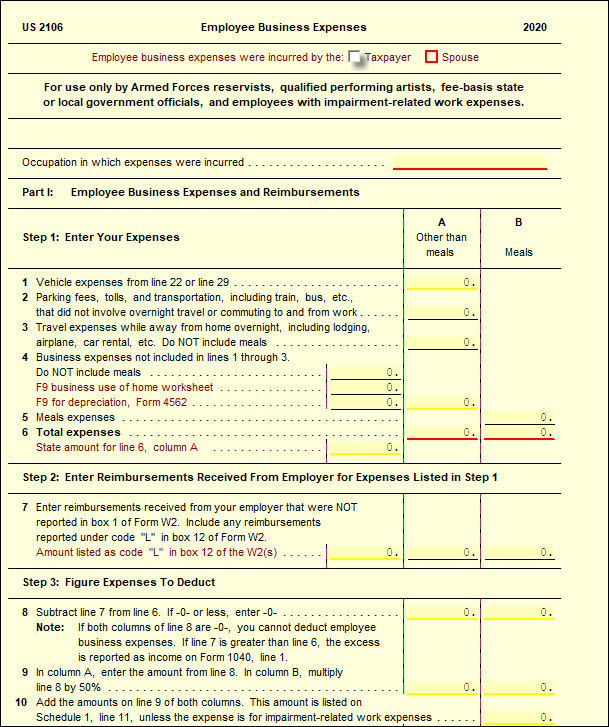

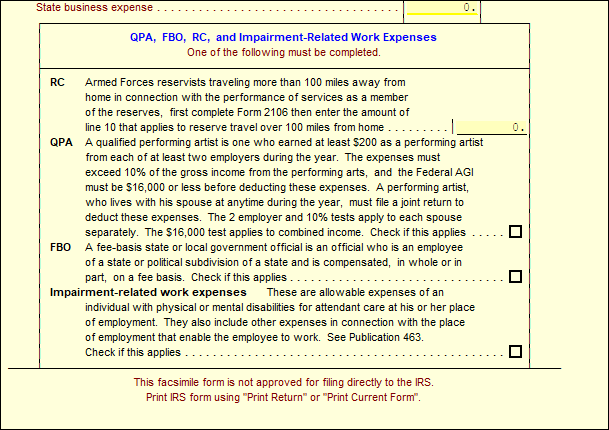

What is the form used for?

Employees file this form to deduct ordinary and necessary expenses for their job.

- An ordinary expense is common and accepted in your field of trade, business, or profession.

- A necessary expense is helpful and appropriate for your business. An expense does not have to be required to be considered necessary.

Is the form Supported in our program? 2106 is supported in the 1040 package for both Online and Desktop platforms.

How to access the form: In a return, use the Add Form function to add a new 2106 form to the return.

Limits to the form: There is no limit to the number of 2106 forms. When completing Form 2106 for the taxpayer and the spouse, the taxpayer's form must be started first, or the IRS will reject the return.

Solution Articles:

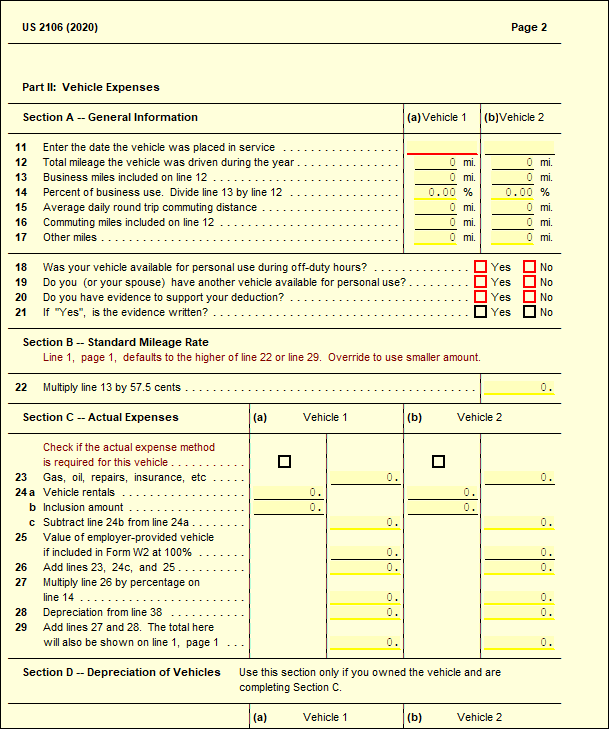

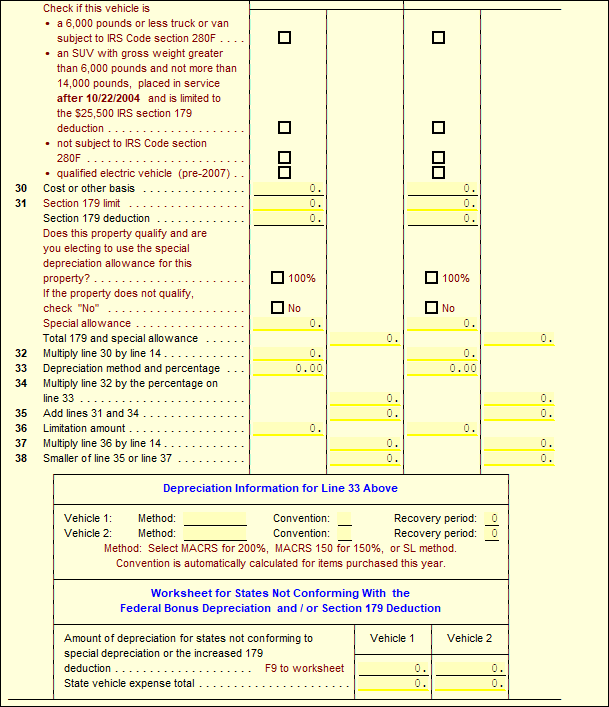

Form 2106: Entering employee home office expenses

IRS Link: https://www.irs.gov/forms-pubs/about-form-2106