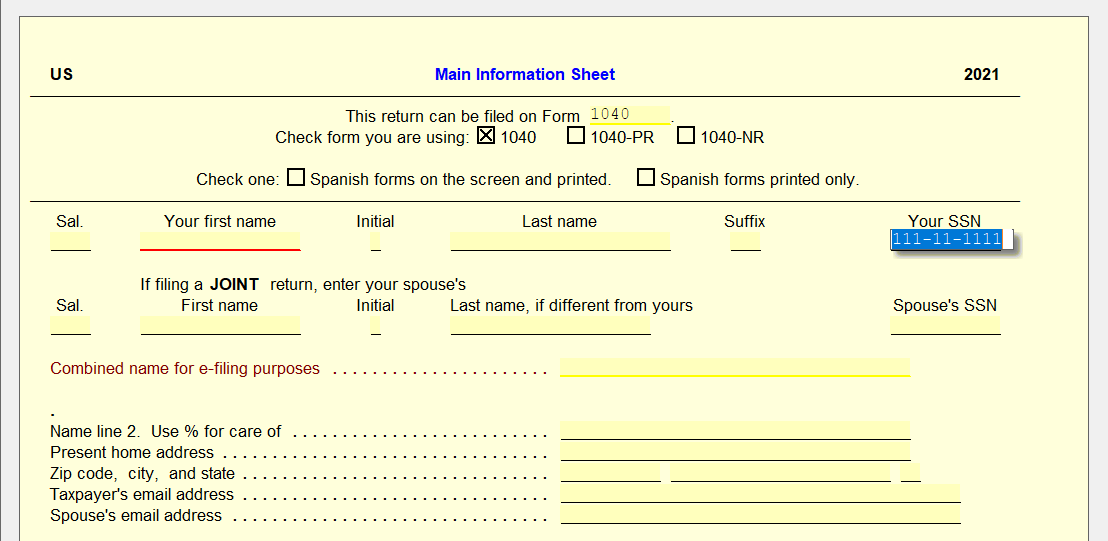

Issue: The last name for the primary taxpayer on the return does not match what the IRS and/or the Social Security Administration (SSA) have on file. This could be caused by a misspelling of the primary taxpayer’s last name or using the wrong SSN for the primary taxpayer. It can also result from multiple or hyphenated last names or if a taxpayer changed his/her last name and has not notified the SSA.

Solution: Check the primary taxpayer's name and social security number against the social security card. If the information entered matches exactly, have the taxpayer contact the Social Security Administration at 1-800-772-1213 to correct the Social Security Administration records. This process takes approximately two weeks for the information to be updated in the IRS e-File database.

This information applies to all years of the UltimateTax software.